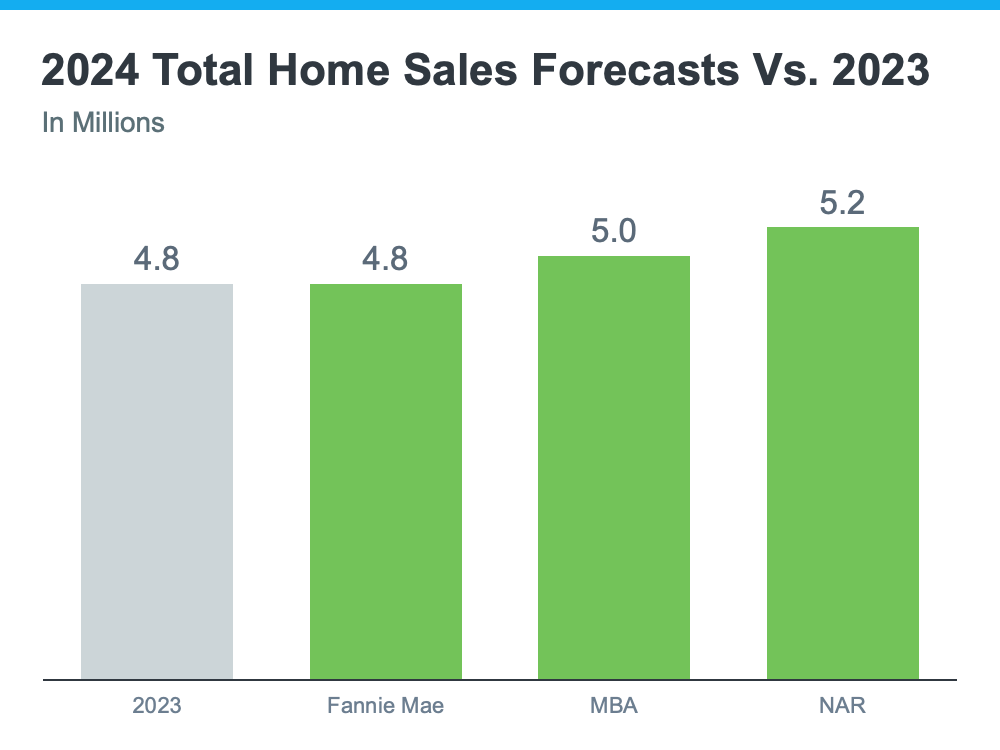

This is the time when a lot of people take a moment to reflect and set their goals for this year. And as you picture what you want your 2025 to look like, one thing that may pop into your mind is the vision of you in a new home. But how do you get there? And where do you start?

Here’s some advice that can help you get the ball rolling.

Focus on Your Why

To lay the foundation, you need to focus on your why. While the dollars and cents are important, so is the driving force behind your desire to move. Maybe you need more space for a growing family, want to sell so you can downsize, or are finally ready to buy your first home. Whatever your reason, it’s important to keep it front and center.

Your why is what helps you stay focused. Share your motivation with your agent and they’ll use their expertise to help support that goal, no matter what the market looks like. With a great agent by your side, you’ll have someone to guide you, problem-solve, and keep you moving forward until you can check that goal off your to-do list.

Get Clear on What You Need

Then it’s time to figure out what your next home needs to have. How many bedrooms do you need? If you don’t have a designated home office, is that a deal-breaker? What about a big fenced-in backyard? Knowing your must-haves and nice-to-haves makes the search a lot smoother.

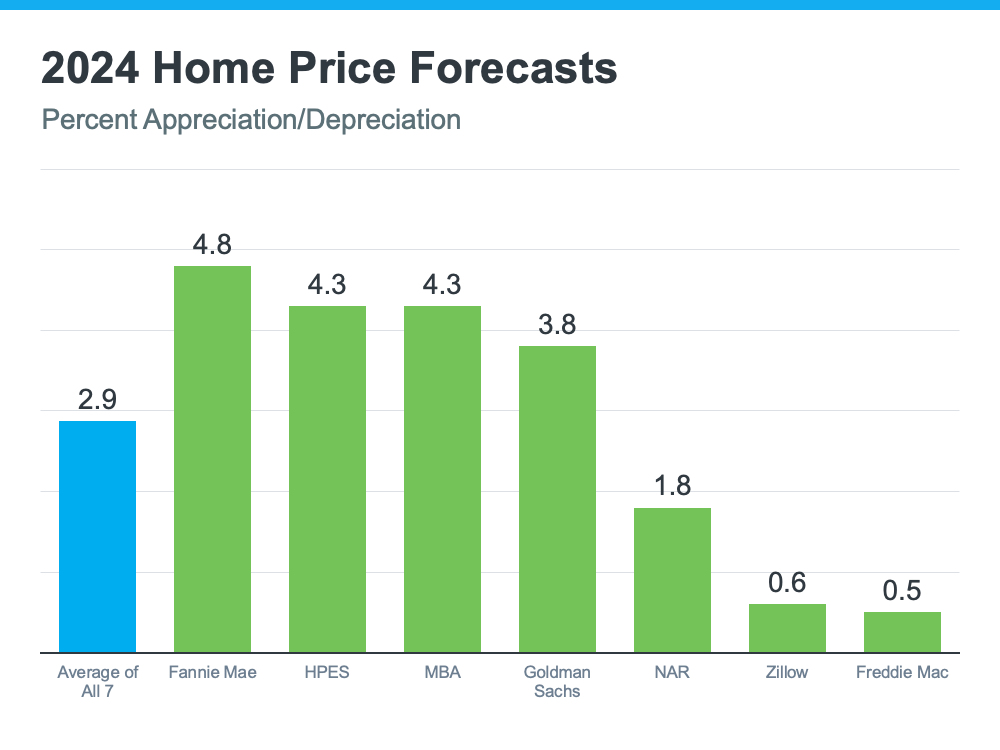

Since affordability is still tight, it’s important to have a clear idea of your essential items upfront. Maybe you can flex a bit on location, if it’s got everything else you’re looking for. Go over those essential items with your agent and they’ll help you focus on the homes that check the boxes that matter most while staying within your price range.

Know Your Numbers

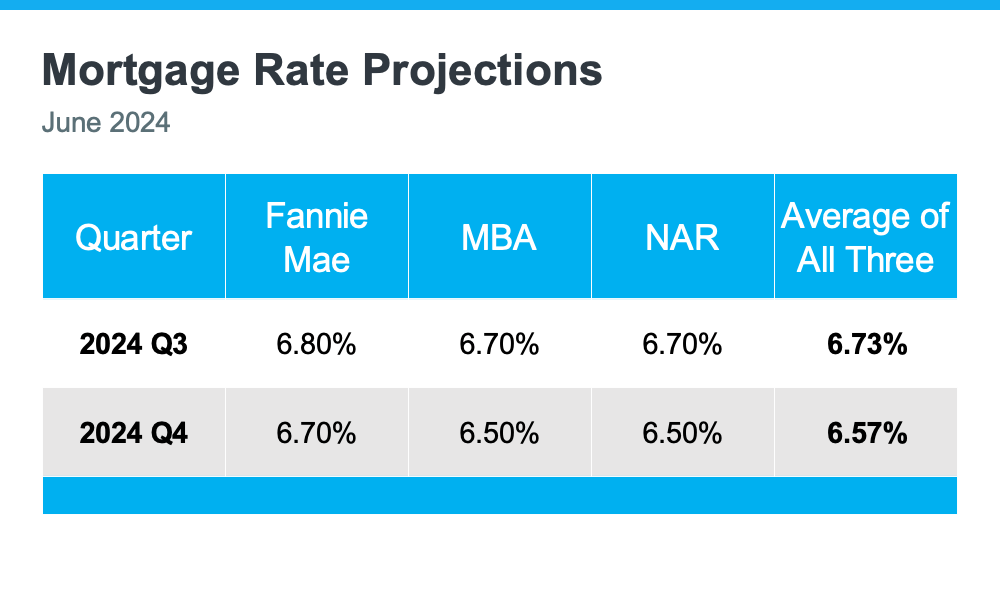

Before you jump in, take a look at your finances. How much have you saved? What monthly payment feels comfortable? Getting clear on your budget early will help you know what’s possible.

The best way to do this is by partnering with trusted real estate professionals, like a local agent and a lender. They’ll help you:

- Plan for your down payment and look into down payment assistance programs

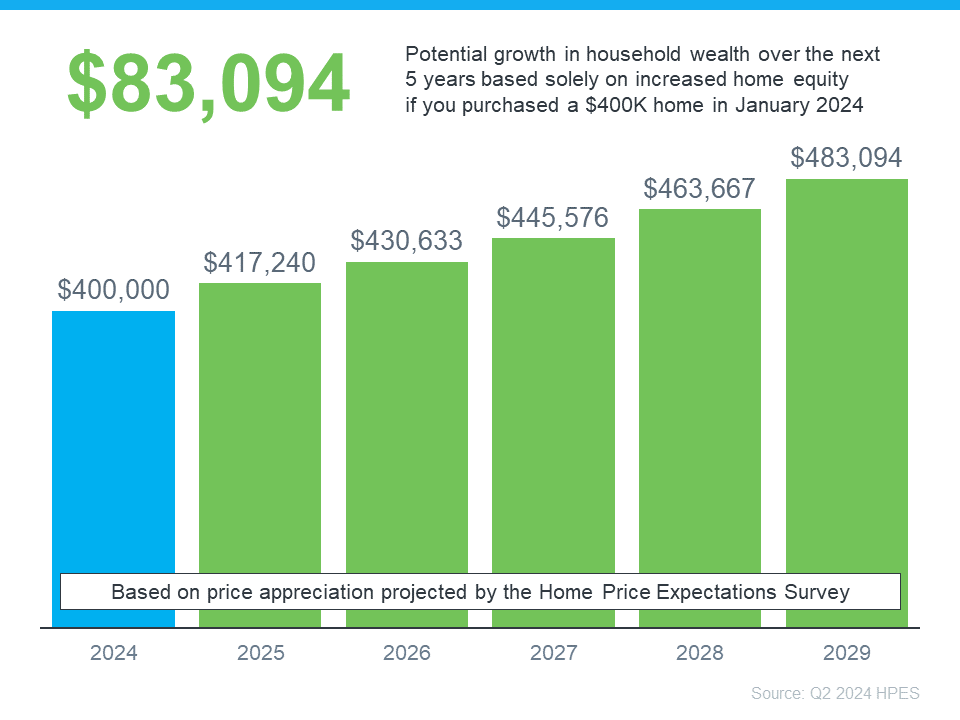

- Understand the equity you have in your current home and how you can use it to fuel your next move if you’re selling

- Get pre-approved for a mortgage so you know what you can borrow

Lean on a Pro To Guide You

It can be hard to know where to start, but you don’t have to do it alone. A real estate agent knows what you need to do to get ready to buy or sell, how to navigate the process, and can answer your questions every step of the way. As Bankrate puts it:

“. . . now more than ever, it’s smart to lean on the guidance of an experienced local real estate agent. If you want to enter the housing market in 2025, whether as a buyer or a seller, let a pro lead the way for you.”

Remember, buying or selling is a big milestone and a great goal for this year. With the right expert on your team, you’ll feel confident and ready to take on the market.

Bottom Line

If buying or selling a home is part of your goals for 2025, now’s the time to get started. Focus on your why, know what you need, and connect with trusted pros to make it happen. Let’s team up and make this the year you accomplish your real estate resolutions.