In March, the real estate market in Dunwoody, Sandy Springs, and neighboring areas experienced a notable upswing in activity. The decline in mortgage rates during the month led to a surge in demand from buyers, resulting in a situation similar to last spring. As a result, there was an abundance of property viewings, multiple offers, and bidding wars, all of which resulted in stronger prices for sellers. Overall, the market was the strongest we’ve seen in 2023.

Key Points

- Dunwoody’s average sales price increased significantly from the previous month – breaching the 700s, while Sandy Spring’s remained relatively unchanged.

- Average days on market for both Dunwoody and Sandy Springs remained fairly steady – however, they are higher than this time last year.

- Both Dunwoody and Sandy Springs only saw minuscule increases in new homes on the market.

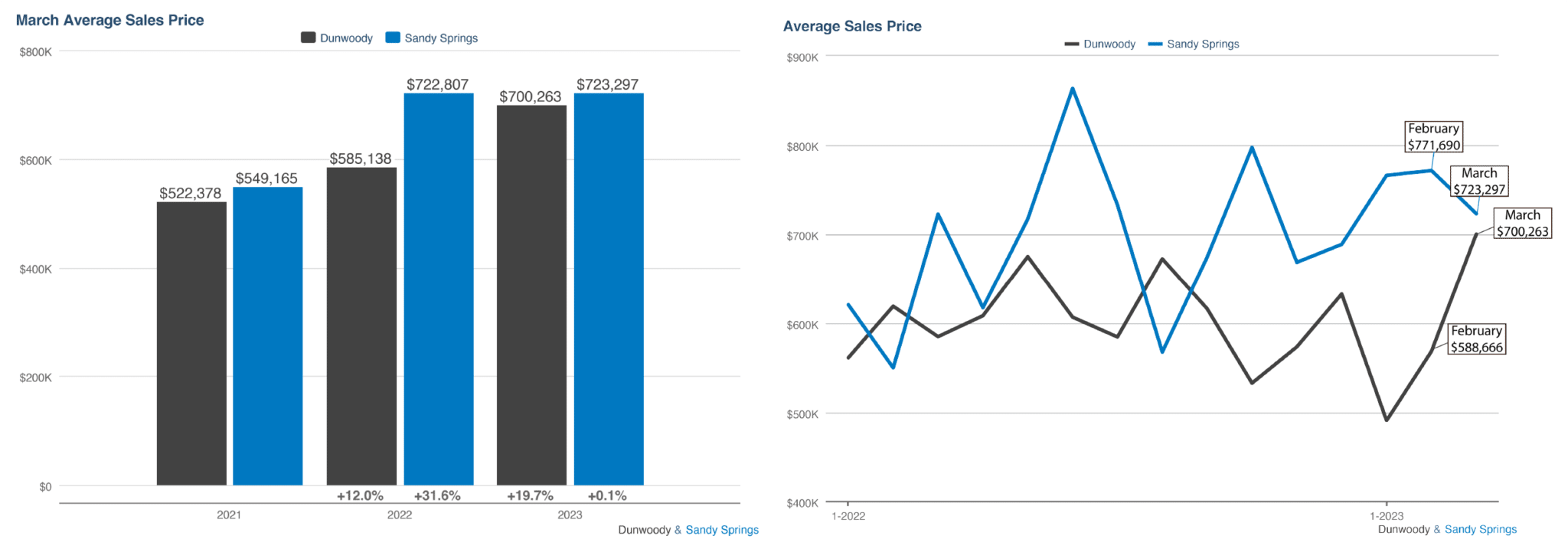

Average Sales Price

The average sales price in Sandy Springs for March 2023 was $723,297, representing a 6.27% decrease from February but only a 0.1% change from March 2022. Meanwhile, in Dunwoody, the average sales price increased significantly from $568,666 to $700,263, which is a 23.12% increase. Compared to last year’s period, the average price in Dunwoody is now 20% higher.

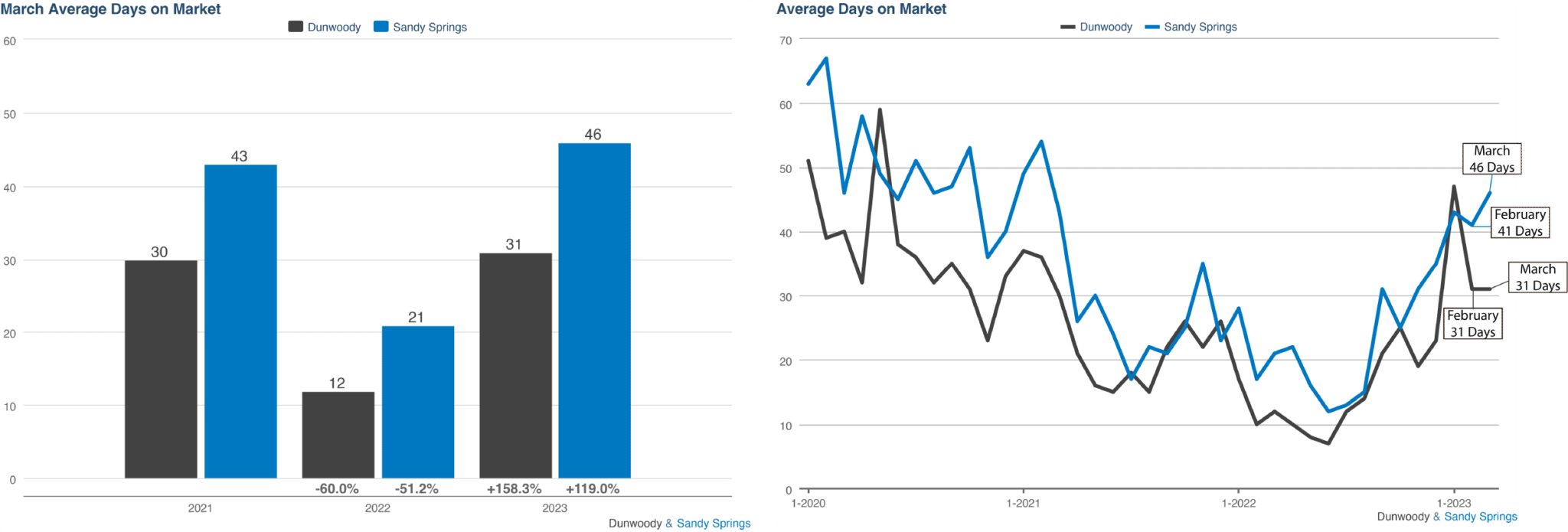

Average Days on Market

While the average days on market for both Dunwoody and Sandy Springs remained steady, they were strikingly higher than this time last year. Dunwoody’s average days on the market remained unchanged from February at 31 days, but this represents a significant 158.3% from last year when the average days on market was 12. Meanwhile, Sandy Springs experienced a slight increase in the average days on the market from 41 to 46 days. Like Dunwoody, the average days on the market in Sandy Springs was also much lower in March 2022 at only 21.

The fluctuation in days on the market over the past year can be attributed to several factors. Notably, homes listed during the holiday season and early months of the year, when mortgage rates were higher, may have gained more traction during the spring market in light of the subsequent drop in rates.

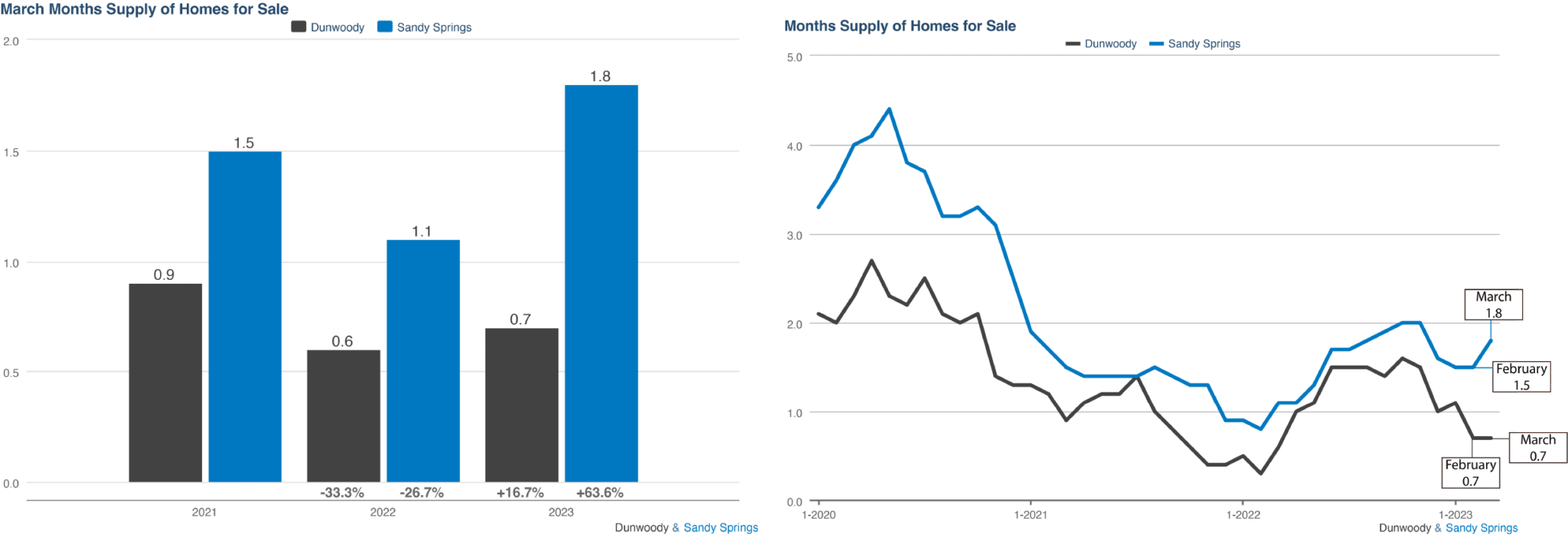

Months Supply of Homes for Sale

Dunwoody saw no change in months supply remaining at 0.7 from February. Meanwhile, Sandy Springs increased slightly from 1.5 to 1.7 months supply, which is a 63.6% increase from March 2022.

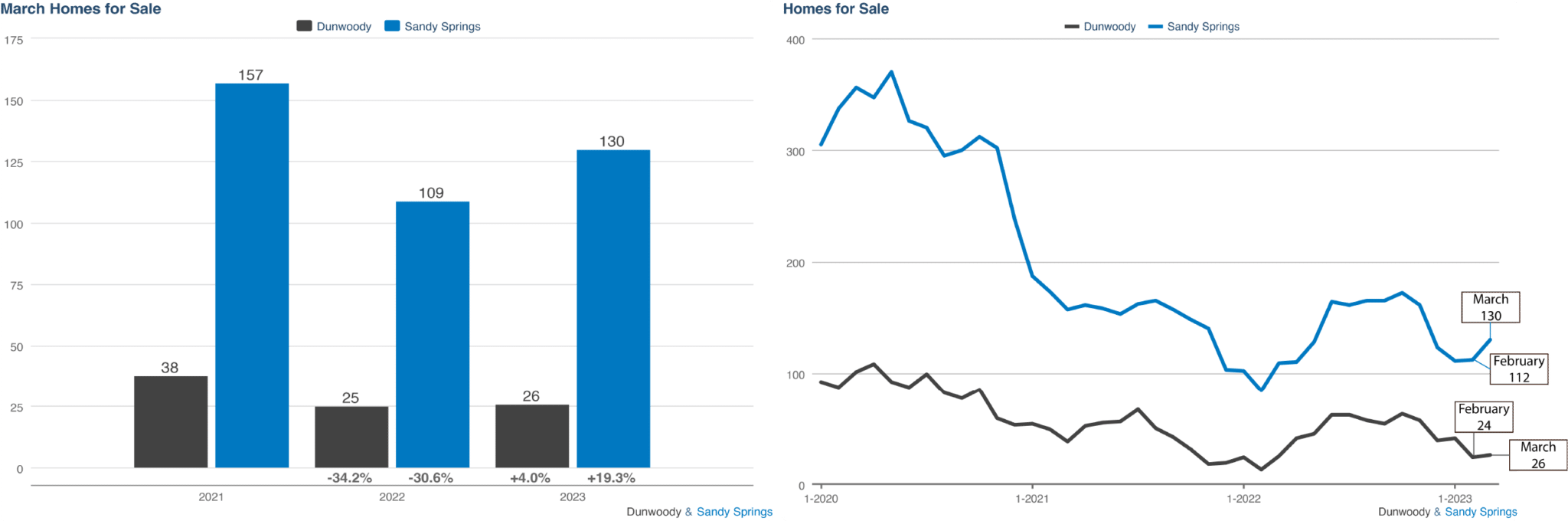

Homes for Sale

Both Dunwoody and Sandy Springs only saw minuscule increases in new homes on the market. Dunwoody saw relatively no change from the previous month, going from 24 to 26 homes for sale. Sandy Springs also increased only slightly from 112 to 130 homes for sale.

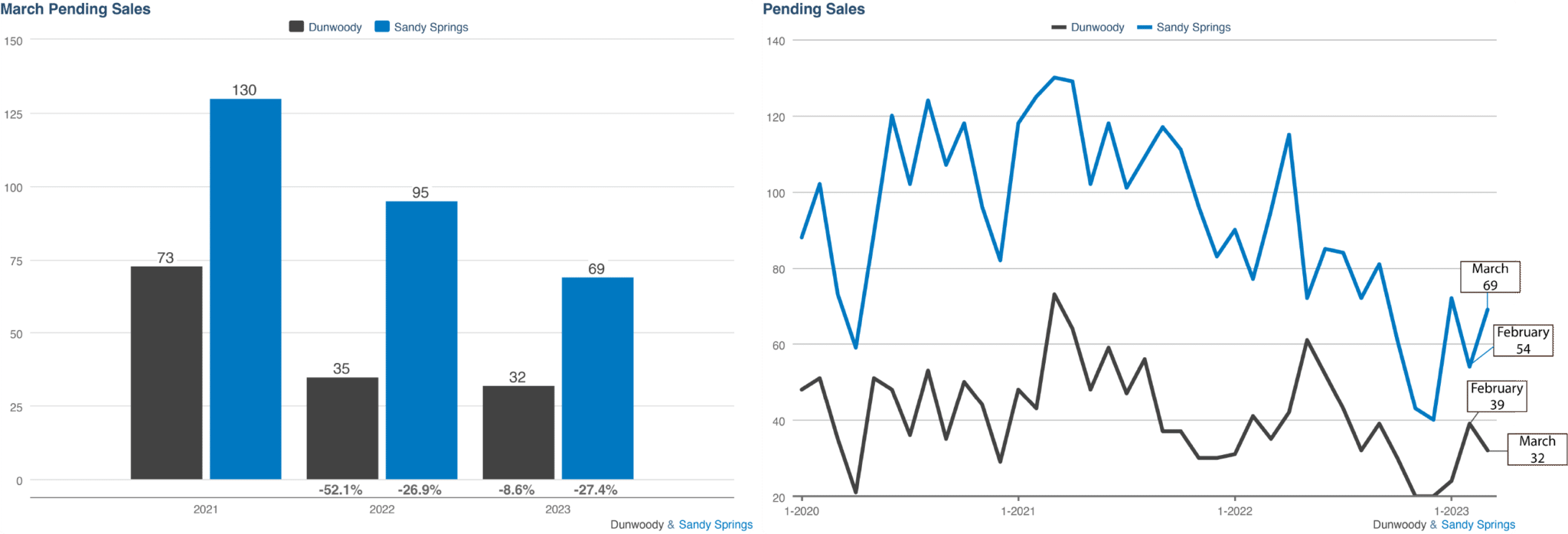

Pending Sales

Pending sales typically take between 15 and 60 days from contract to closed sale. Some homes will close while other contracts will. Pending sales is still a valuable metric for understanding the types of homes – and locations – that buyers are looking for.

Sandy Springs saw a 27.78% increase – 54 to 69 pending sales- from February to March, and Dunwoody’s pending sales decreased from 39 to 32 pending sales – a 17.95% decrease. Sandy Springs had a 27.4% decrease in pending sales from March 2022, which had 95. Dunwoody saw relatively no change from March 2022, decreasing only by 8.6%.

Key Takeaway

In summary, the real estate market in Dunwoody and Sandy Springs experienced remarkable growth at the start of the spring market. While Sandy Springs didn’t see as much as Dunwoody, it’s still high in demand and a strong seller’s market with low inventory and good prices. Dunwoody’s market is a strong seller’s market with very low inventory of homes for sale and demand at its highest. The market in both areas is expected to remain active and competitive in the near future.

*All data from First Multiple Listing Service. InfoSparks© 2023 ShowingTime.