Whether you’re a potential homebuyer, seller, or both, you probably want to know: will home prices fall this year? Let’s break down what’s happening with home prices, where experts say they’re headed, and why this matters for your homeownership goals.

Last Year’s Rapid Home Price Growth Wasn’t the Norm

In 2021, home prices appreciated quickly. One reason why is that record-low mortgage rates motivated more buyers to enter the market. As a result, there were more people looking to make a purchase than there were homes available for sale. That led to competitive bidding wars which drove prices up. CoreLogic helps explain how unusual last year’s appreciation was:

“Price appreciation averaged 15% for the full year of 2021, up from the 2020 full year average of 6%.”

In other words, the pace of appreciation in 2021 far surpassed the 6% the market saw in 2020. And even that appreciation was greater than the pre-pandemic norm which was typically around 3.8%. This goes to show, 2021 was an anomaly in the housing market spurred by more buyers than homes for sale.

Home Price Appreciation Moderates Today

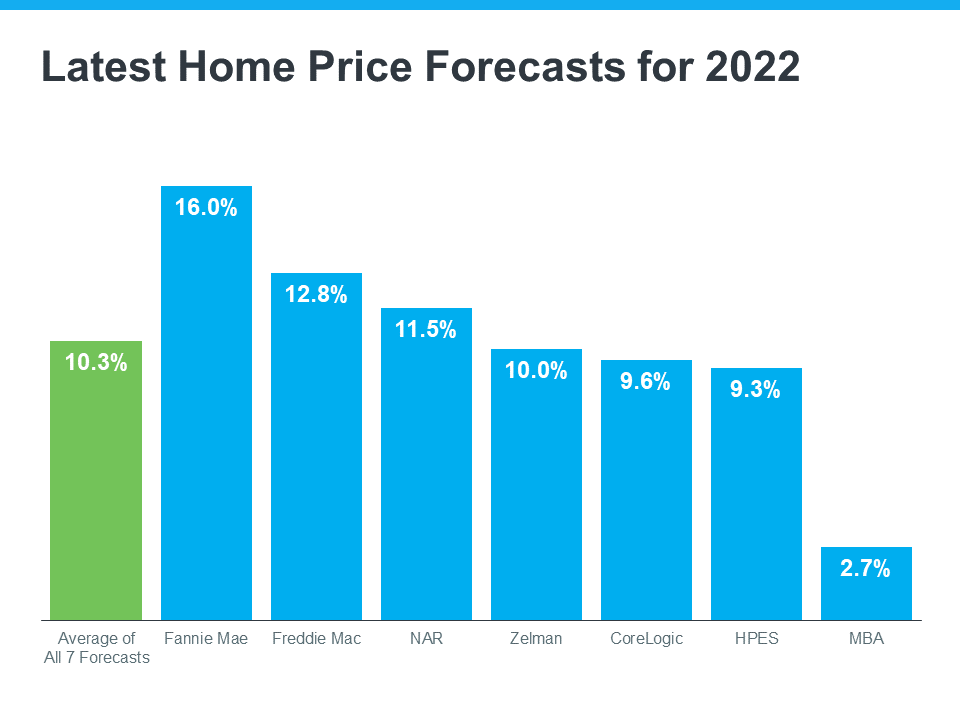

This year, home price appreciation is slowing (or decelerating) from the feverish pace the market saw over the past two years. According to the latest forecasts, experts say on average, nationwide, prices will still appreciate by roughly 10% in 2022 (see graph below):

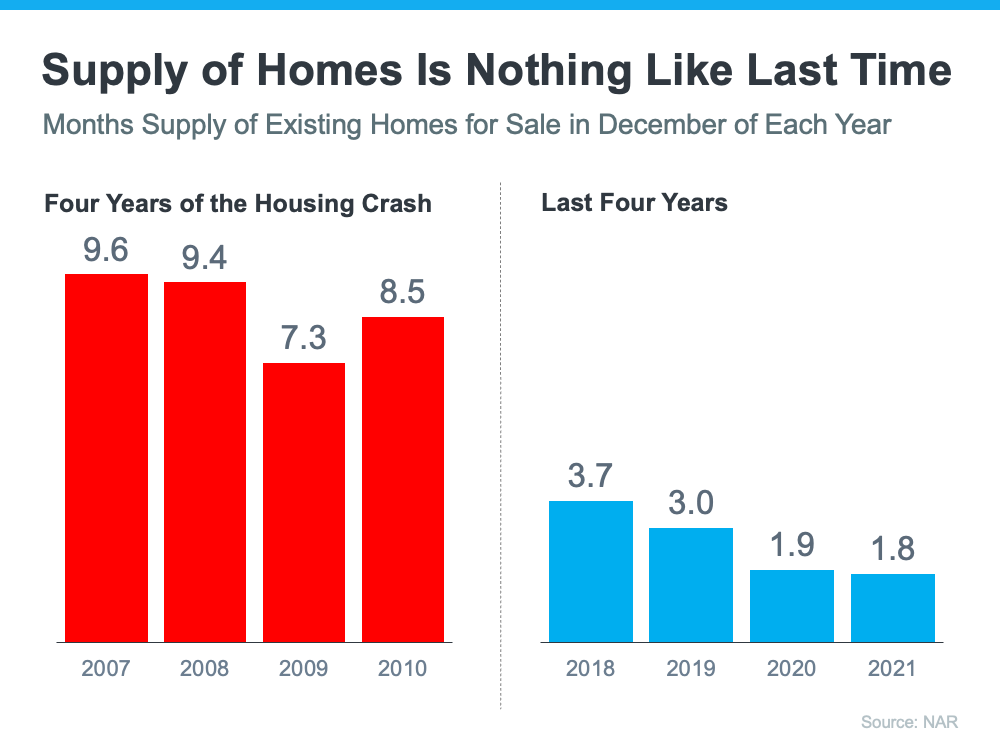

Why do all of these experts agree prices will continue to rise? It’s simple. Even though housing supply is growing today, it’s still low overall thanks to several factors, including a long period of underbuilding homes. And experts say that’s going to help keep upward pressure on home prices this year. Additionally, since mortgage rates are higher this year than they were last year, buyer demand has slowed.

As the market undergoes this change, it’s true price appreciation this year won’t match the feverish pace in 2021. But the rapid appreciation the market saw last year wasn’t sustainable anyway.

What Does That Mean for You?

Today, the market is beginning to move back toward pre-pandemic levels. But even the forecast for 10% home price growth in 2022 is well beyond the 3.8% that’s more typical for a normal market.

So, despite what you may have heard, experts say home prices won’t fall in most markets. They’ll just appreciate more moderately.

If you’re worried the house you’re trying to sell or the home you want to buy will decrease in value, you should know experts aren’t calling for depreciation in most markets, just deceleration. That means your home should still grow in value, just not as fast as it did last year.

Bottom Line

If you’re thinking of making a move, you shouldn’t wait for prices to fall. Experts say nationally, prices will continue to appreciate this year, just at a more moderate pace. When you’re ready to begin the process of buying or selling, let’s connect so you have a local market expert on your side each step of the way.